|

Finance and Management

Reference:

Bai Y., Fastovich V.V.

Analysis of the dynamics of development and competitiveness of the Chinese gas industry

// Finance and Management.

2022. ¹ 2.

P. 15-29.

DOI: 10.25136/2409-7802.2022.2.37754 URL: https://en.nbpublish.com/library_read_article.php?id=37754

Analysis of the dynamics of development and competitiveness of the Chinese gas industry

Bai Izhan'

Postgraduate student, Department, Faculty of Public Administration, Federal State Budgetary Educational Institution of Higher Education "Lomonosov Moscow State University"

119991, Russia, Moskovskaya oblast', g. Moscow, Lomonosovskii prospekt, 27, korpus 4

|

fastyiran.@gmail.com

|

|

|

|

Fastovich Vladimir Vladimirovich

Master's Degree, Department, Faculty of Public Administration, Federal State Budgetary Educational Institution of Higher Education "Lomonosov Moscow State University"

119991, Russia, g. Moscow, Lomonosovskii prospekt, 27, korpus 4

|

yanfengkang@gmail.com

|

|

|

|

DOI: 10.25136/2409-7802.2022.2.37754

Received:

28-03-2022

Published:

12-04-2022

Abstract:

The object of research of this article is the natural gas industry of China, special attention is paid to competitive strength. Michael Porter's models cover many issues of the competition problem. The authors use M. Porter's five competitive forces to analyze China's gas industry. Together, these five factors influence the attractiveness of the industry and the decisions of competitive strategies in its place. Changes in various combinations of the five forces ultimately affect changes in the potential profit of the industry. The authors reveal the space of competitive forces, the competitive environment in the gas industry of the People's Republic of China, identified the driving and restraining forces of the gas industry of the People's Republic of China. The main conclusions of the study are: the main driving force in the gas industry in China comes from buyers, the restraining force in the gas industry in China mainly comes from the main competitors of the industry. China's economic development, demand for clean energy and increasingly advanced technologies for the development and use of natural gas are driving the development of China's gas industry. The raw materials of gas in China are highly dependent on imports, the construction of the infrastructure of the gas industry is difficult and expensive, and the efficiency of the use of the built gas industry is insufficient. Identification and analysis of the driving and binding forces of the industry, and the development of countermeasures are especially important to ensure the sustainable development of the industry.

Keywords:

Chinese gas industry, competitive forces, Porter 's model, threats, suppliers, buyers, energy consumption structure, driving forces of the industry, restraining forces of the industry, competition

This article is automatically translated.

You can find original text of the article here.

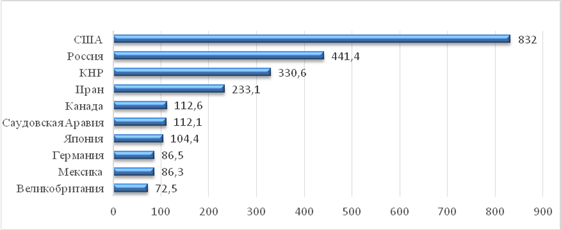

Introduction The development of the gas industry is one of the most important sectors among many sectors of the economy. The relevance of this work lies in the fact that natural gas plays an important and specific role in various branches of material production not only in China, but also the partner countries, which have signed contracts. The development of technology, the growth of demand for gas and a General increase in energy prices inevitably lead to the creation of a global gas market. Chinese gas industry can be divided into three segments: production, transportation and sale. The corresponding price of natural gas is divided into four parts: the Franco-factory price, fee for transportation by pipeline, the fee for the distribution of gas and the price for the end user. The research object of this article is the natural gas industry in China, special attention is paid a competitive force. The subject of research is the factors of the dynamics of exports and imports of gas (which are also reflected in the composition of the gas industry of China). The problem can be formulated as the complexity of the assessment of the dynamics of the industry without identifying what are the key driving and restraining forces in the gas industry of China. Accordingly, the aim of this work was to analyze the influence of various factors affecting the growth and development of the gas industry, in particular, the interests of buyers, the dynamics of production, a trend towards the use of clean energy, etc. and to identify the most significant. It is necessary to solve the following tasks: analysis of imports and exports of gas over the last decade, the structure of energy consumption in China and the threat from alternative fuel sources, and to evaluate the competitive forces operating in the gas industry of China on the model of M. porter This theme was developed by many domestic and foreign scientists. Primary sources are the writings of economist M. porter. Among Chinese researchers select Whether Lingling, who formulated the point of view of wisdom on the analysis of the status and prospects of the gas industry at the present stage, and Zhao is an easy, offered 7 tips to help you achieve business value on natural gas. Among foreign authors in this study are of greatest interest of work in terms of competitiveness and strategic management: A. K. Alexandrov, D. directory and T. A. Gileva. The scientific novelty of this work is to identify the main driving forces in the current conditions, as well as insights about the main challenges in this direction on the basis of which the further stages of the study will be discussed in more detail measures identified in the study areas. Overview of the Chinese gas industry. Due to the fact that the gas industry of China will not be able to meet the rapidly growing demand for gas production from its own resources (tab.1), the gas industry of China depends on imports of hydrocarbons. Source of natural gas in this case can be as traditional resources of land and sea fields and unconventional resources, such as deepwater fields, shallow deposits under the bottom of the ocean, methane hydrates, shale gas, coal bed methane, etc. [13] After the separation of ethane and higher fractions of hydrocarbons from methane, he will be transported either in the form of LNG tankers-metanopoli or through pipelines. World primary energy consumption fell by 4.5% in 2020, the biggest decline since 1945. However, the share of natural gas continued to grow 24.7%. While the supply and demand of energy worldwide to weaken, the annual growth rate in natural gas consumption in China in 2020 will amount to 6.9%, which will amount to 8.6% of world consumption of natural gas. Over the last decade, natural gas consumption in China increased from 108.9 billion cubic meters in 2010 to 330.6 billion cubic meters in 2020 (Fig.1). In 2020, the volume of imports of natural gas will reach 139.1 billion cubic meters, and the external dependence reached 41.5% [1, p. 42]. This reflects the growing China's dependence on foreign natural gas and China's dependence on imported hydrocarbons (tab.1). Natural gas imports in China is as marine liquefied natural gas (LNG), and land (pipeline gas) routes. Participants of the market of gas industry of China are mainly three public companies: China national petroleum Corporation (CNPC), China petroleum and chemical Corporation (Sinopec) and China national offshore oil Corporation (CNOOC). Table 1. Mining and gas imports in China over the past 10 years. (units of 1 billion cubic meters) [1] | |

2010. | 2011. | 2021. | 2013. | 2014. | 2015. | 2016. | 2017. | 2018. | 2019. | 2020. | | Gas production | 95.6 | 106.2 | 111.5 | 121.8 | 131.2 | 135.7 | 137.9 | 149.2 | 161.4 |

177.6 | 194.0 | | Gas imports | Natural gas imports via pipeline | 3.4 | 13.6 | 20.8 | 26.4 | 30.3 | 32.4 | 36.8 | 39.9 | 47.9 | 47.7 | 45.1 | | LNG imports | 13.0 | 16.9 |

20.1 | 25.1 | 27.3 | 27.0 | 36.8 | 52.9 | 73.5 | 84.7 | 94.0 | | Total imports | 16.4 | 30.5 | 40.8 | 51.5 | 57.5 | 59.4 | 73.6 | 92.8 | 121.3 |

132.5 | 139.1 |

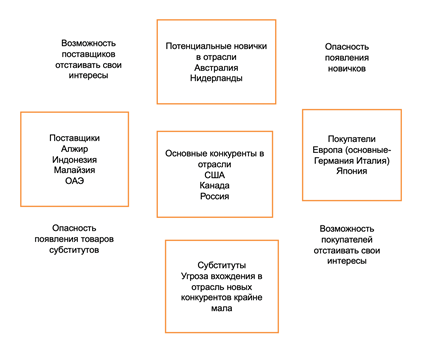

Figure 1. Top 10 largest consumers of natural gas in the world in 2020 (units bcm) [1, p. 38] Why the rivalry of some countries win and others lose? Of the issues related to the economy, perhaps this sounds in our time especially often. Competitiveness – this is what primarily concerned about the government and industry of any country [18, c. 30]. The adaptation of enterprises to competitive unstable and volatile external environment should be done in a comprehensive and continuous analysis of competitors ' activities, a private strategic potential and assessment of the effectiveness of its use, as well as determining the position of the enterprise in the market of goods and services relative to competitors, i.e. assessment of competitiveness of the enterprise [4]. In the current economic situation, the heads of enterprises and organizations of various forms of ownership need to be wise, cautious policy of development of their companies. This is especially true for the gas industry. The status of the company depends on how successfully it is able to react on different outside influences. Analyzing the external situation, it is necessary to highlight the most significant for a specific period of time factors. An interrelated consideration of these factors with the company's possibilities allows to solve problems. To determine the position of the enterprise in the market it is necessary to analyze the structure of competition, depending on the industry in which the company operates. This can be done on the basis proposed by M. porter's model of competition analysis [15]. Economist M. porter suggested that the nature of competition and its driving forces. The competition involves not only the market players, consumers, suppliers, potential players and substitute products are all competitors, in varying degrees, affect the development of the industry [19]. The result of the researches of M. porter was the concept of the five forces of competition. According to this concept, the state of competition in a given market can be characterized by the interaction of the five competitive forces (Fig.2): l the threat of invasion of new competitors; l the threat of substitutes; l economic potential suppliers; l economic potential buyers; l the rivalry among the existing competitors [20].

Figure 2. An assessment of the competitive forces operating in the gas industry of China on the model of M. porter Analiz threat of new entrants. The gas industry is a special industry, which is associated with the strategic security of the country. The Chinese government has strict rules in this industry. Without the approval of the government, other businesses and individuals not permitted to enter the industry. Beginner restricted funds and technology. Therefore, threat of new entrants in China is low. However, large foreign energy and oil companies are differently involved in the gas industry of China, in connection with the globalization process [23]. These foreign oil companies are unlikely to compete with the three major Chinese oil companies in the upstream sector. Competition can be concentrated only in processing plants, especially in the consumption of refined oil. Threat analysis of the emergence of substitutes.

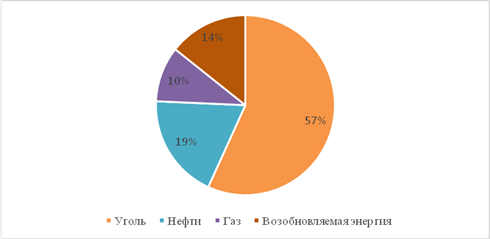

Existing alternatives are: Coal, nuclear energy, hydropower, solar energy, etc. With the current technological point of view, renewable energy accounts for only 14% of the total energy demand in China in 2020, and may not be the main source of energy for an extended period of time [17]. In 2020, coal is the main energy source in China, which accounted for 57% of the consumption of energy [Fig.3]. However, the consumption of coal has led to a massive environmental pollution of China. As China attaches great importance to environmental protection, the use of oil and natural gas in the energy sector largely encouraged and supported. The General trend of energy consumption in China is that the share of coal gradually decreases and the share of consumption of oil and natural gas is increasing [2].

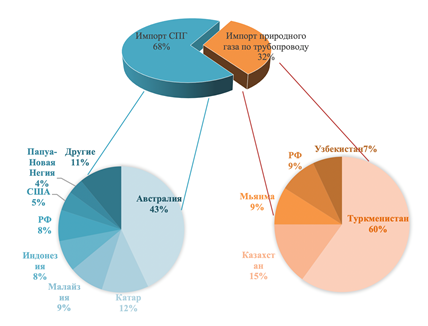

Figure 3. Structure of consumption by type of energy sources in China by 2020. (in %) [3] Analiz market power of suppliers. In terms of volatility of market suppliers play a crucial role in the development of the gas industry in China.In 2020, natural gas imports in China will come from a variety of sources. 24 is an exporter of LNG and Australia is the most important exporter, which accounts for 43%, followed by Qatar, Malaysia, Indonesia, Russia and the United States. The above six countries account for 85% of all imports [Fig.4]. Exporters of natural gas by pipeline is basically the country's border with China on land, of which the share of Turkmenistan accounts for 60%, followed by Kazakhstan, Myanmar, Russia and Uzbekistan [21].

Figure 4. The sources of the main importing countries on China's natural gas market in 2020 The market power of consumers. Early Chinese, the price of gas has not been fully liberalized and trading at an estimated price of government, but the price has been changed due to changes in international oil prices. Thus, the effect of purchasing power is limited. In China's consumption in 2021, the share of Eastern China and Northern China exceeded 20%. Among them, Sichuan, Chongqing, Shaanxi, Xinjiang and other large provincial natural gas producers constitute a relatively high proportion of natural gas consumption; the Top 3 in gas consumption in the provinces, municipalities of China in 2020 (tab. 2): Guangdong province (9.8%), Jiangsu (8.4%), Sichuan province (7.2%). Table 2. Gas consumption in the provinces and municipalities of China in 2021 (billion cubic meters) [24] | Province/municipality | Consumption | Share % | | Guangdong | 364 |

9.8 | | Jiangsu | 313.7 | 8.4 | | Sichuan | 268 | 7.2 | | Shandong | 236.6 | 6.3 | | Beijing | 217.05 | 5.8 | | Zhejiang | 180 | 4.8 | | Shaanxi | 172 | 4.6 | | Xinjiang |

References

1. BP Statistical Review of World Energy 2021. P. 36-42. [Electronic resource]: URL https://www.bp.com/content/dam/bp/business-sites/ en/global/corporate/pdfs/energy-economics/statistical-review/bp-stats-review-2021-full-report.pdf. (date of access: 10.12.2021).

2. China gas consumption outstrips production in 2016 Beijing. January 29. Interfax China. [Electronic resource]: URL http://www.interfax.cn/news/21423 (accessed: 12/10/2021).

3. National Bureau of Statistics of China. [Electronic resource]: URL http://www.stats.gov.cn/tjsj/ndsj/2010/indexch.htm (Accessed: 20.09.2021)

4. Alexandrov A. K. Competitiveness of an enterprise (firm) / [Alexandrov A. K. et al.]; under total ed. V. M. Kruglika Minsk M. : New knowledge : INFRA-M, 2013.-66 p.

5. Basovsky, L.E. Strategic management: a textbook for students of higher educational institutions studying in the direction 080200 "Management" / L. E. Basovsky.-Moscow: INFRA-M, 2012.-363 p.

6. Gileva, T.A. Strategic management of innovative business / T. A. Gileva-Ufa: USATU, 2021.-436 p.

7. Danilyuk, A. A. Change management: textbook / A. A. Danilyuk. FGBOU VPO Tyumen State University, Institute of Finance and Economics.-Tyumen: 2014.-287 p.

8. Kmaeva, R.I. Strategic management: a textbook for students studying in the specialty "Organization Management" / R. I. Akmaeva.-Moscow: Wolters Kluver, 2010.-419 p.

9. Kulagin. B. Long-term prospects for the development of the global gas market // 4th International Conference. "Global oil and gas markets: tougher competition", Moscow, December 13, 2016.10.

10. Li Lingling. Analysis of the state and development prospects of the Chinese gas industry in 2018. Wisdom point of view. [Electronic resource]: Access mode /http://www.chyxx.com/industry/201803/624011.html (date of access: 01/15/2022).

11. Luolin. From January to December 2021, China's gas industry production scale and import market panorama Annual natural gas production has exceeded 200 billion cubic meters. Prospective database. [Electronic resource]: URL: https://d.qianzhan.com/xnews/detail/541/220319-c5c94cdf.html

12. Mastepanov A., Kovtun V. China forms the gas industry of the XXI century // Oil and Gas Vertical. 2012. No. 6. P. 42–56.

13. Matveev. V.A. China's international cooperation in the gas sector as a strategic priority of China's modern energy policy // China in World and Regional Politics. History and modernity. [Electronic resource]: URL: https://cyberleninka.ru/article/n/mezhdunarodnoe-sotrudnichestvo-knr-v-gazovoy-sfere-kak-strategicheskiy-prioritet-sovremennoy-energeticheskoy-politiki-kitaya

14. Mikhailova, Yu. V. Development of regional clusters for the production of medical equipment: monograph / Yu. V. Mikhailova, V. I. Samaruha; Ministry of Education and Science of the Russian Federation, Free Economic Society of Russia, Baikal State University.-Irkutsk: BSU Publishing House, 2017.-152 p.

15. Moiseeva. T.P. Russia in the context of development trends of modern society: a textbook for full-time students enrolled in the direction of bachelor's degree 38.03.01 "Economics" / TP Moiseeva. Ufa: RICK UGATU, 2018.-161 p..

16. China Natural Gas Development Report (2021). Ministry of Natural Resources of China, September 2021 [Electronic resource]: URL: https://finance.sina.com.cn/wm/2021-09-09/doc-iktzqtyt4967442.shtml[

17. Popov. SP China's gas industry: a new development resource. Spatial economics. No. 2.2013. [Electronic resource]: URL: http://russian.news.cn/economic/2012-01/04/c_131341990_2.htm (Accessed: 12/12/2021).

18. Porter M. Competitive advantages. M. Alpina-Business Books, 2005.-715 p.

19. Porter. M. International competition: Competitive advantages of countries / Michael Porter.-Moscow: Alpina Publisher, 2020.-948 p.

20. Porter. M. Competition / M. Porter. M., 2005.

21. Distribution of source countries of my country's oil and gas imports in 2020. Data collection of the Chinese energy industry.5,2021 [Electronic resource]: URL: https://zhuanlan.zhihu.com/p/369557341 (Accessed: 01/10/2022).

22. Hanna, David. Leadership for all times: results today-a legacy for the ages / David Hanna; per. from English: [Yu. Sundstrom].-Moscow: Alpina Business Books, 2007.-295 p.

23. Zhao Jinrong. Seven tips to unlock the value of a natural gas business.– Electron. magazine Perspectives, Industrial Clocks, pp. 54-58. [Electronic resource]: URL: https://www.accenture.com/_acnmedia/PDF-133/Accenture-Seven-Tips-to-Unlock-the-Valu-of-Natural-Gas-Business.pdf (accessed: 01/15/2022).

24. Natural gas consumption in the provinces of our country in 2021. LNG industry information 03/21/2022. [Electronic resource]: URL: https://news.bjx.com.cn/html/20220321/1211475.shtml

First Peer Review

Peer reviewers' evaluations remain confidential and are not disclosed to the public. Only external reviews, authorized for publication by the article's author(s), are made public. Typically, these final reviews are conducted after the manuscript's revision. Adhering to our double-blind review policy, the reviewer's identity is kept confidential.

The list of publisher reviewers can be found here.

The subject of the study. Based on the title of the article, its content should be devoted to the results of studying the dynamics of the development of the Chinese gas industry. The content of the article, in general, corresponds to the title, but the author is recommended at the very beginning of the article to give a clear definition of the subject of the study (in particular, an interpretation of the composition of the Chinese gas industry, while answering the question: is gas import included in its composition?). Research methodology. Within the framework of this study, the author analyzes statistical data, the results of which are accompanied by the construction of author's graphic objects (tables and figures). It should also be noted that the M. Porter model is used to assess the competitive forces operating in the Chinese gas industry (in order to ensure consistency of words in the sentence in the title of Figure 2, it is recommended to correct the case of the first letter and the ending in the word "Model" by converting to "models"). Taking into account the chosen research topic, it seems necessary to assess China's ability to further increase gas production. The relevance of the study of issues related to the development of various energy resources, as well as the Chinese economy, is currently beyond doubt, since the state of the world economy and the economies of other countries (including the Russian Federation) depends on both the first and the second, especially given the close economic ties between Russia and China. Scientific novelty is present. In particular, the author's application of the M.Porter model in relation to the chosen research topic seems to be quite original and successful. This made it possible not only to assess the competitive forces operating in the Chinese gas industry, but also to identify factors that increase or decrease their effect. The style, structure, and content of the presentation are scientific, colloquial, and colloquial expressions are absent. The article is structured by highlighting subheadings. At the same time, it is recommended to strengthen the introductory part with a justification of the relevance, subject and object of research, setting goals and objectives of the study. Moreover, it is recommended to add the degree of elaboration of the topic, which will, on the one hand, strengthen the justification for the presence of scientific novelty, and, on the other, ensure that the results obtained by the author are compared with the results of scientific research by other scientists. Speaking about the content of the article, it should also be noted that the author, when highlighting the restraining and driving forces, does not give specific justifications (including using numerical material) for the theses presented. For example, the author notes "a change in the composition of consumers and in the ways of using goods" - and what is the reason for this change? How has the composition of consumers changed? How have the ways of using the product changed? What kind of goods are we talking about – gas or what is produced due to the provision of gas to the Chinese industry, and the need for its volumes is increasing? There should be no declarative judgments in the text of the article. All conclusions, problems and recommendations for their elimination should be as well-reasoned as possible. Moreover, the article in the current version looks unfinished due to the lack of a clear statement of the problems and the author's recommendations for their solution. Bibliography. The author presents a large number of sources in the bibliographic list, both domestic and foreign, which is a positive characteristic of this article. At the same time, these sources, firstly, are carelessly designed (they absolutely do not comply with GOST and even differ from each other in design), and, secondly, the text of the article is not accompanied by an indication of some of them links. It is recommended to eliminate this remark. Appeal to opponents. Despite the extensive list of scientific literature, the author absolutely does not conduct a scientific discussion. Moreover, the degree of elaboration of the topic is not even noted in the introduction, although there are quite a lot of scientific publications on this issue (which is also confirmed by an extensive bibliographic list for the reviewed article) demonstrating the results of research by other authors, which must be noted, including for a clearer and more specific definition and justification of scientific newness. Conclusions, the interest of the readership. The article is distinguished by the originality of the research (which, unfortunately, from the current text appears to be incomplete) and after revision according to these comments (both in content and design) can be recommended for publication. The results of the conducted scientific research presented in the text of the reviewed article are of interest to a wide readership, both in Russia and abroad (and not only among scientists, but also among experts, analysts and specialists of public authorities of the Russian Federation and foreign countries).

Second Peer Review

Peer reviewers' evaluations remain confidential and are not disclosed to the public. Only external reviews, authorized for publication by the article's author(s), are made public. Typically, these final reviews are conducted after the manuscript's revision. Adhering to our double-blind review policy, the reviewer's identity is kept confidential.

The list of publisher reviewers can be found here.

The subject of the research in the reviewed article is the gas industry, the material contains the results of an analysis of its development in China and an assessment of competitiveness. The authors justify the relevance of the work by the fact that natural gas plays an important and special role in various branches of material production not only in China, but also in the partner countries with which contracts have been concluded. The research methodology is based on the study of modern information survey tools, generalization of information sources on the problem under consideration and systematization of scientific information. The scientific novelty of the presented study, according to its authors, "consists in identifying the main driving force in the current conditions, as well as conclusions about the main difficulties in this direction, on the basis of which, at further stages of the study, measures in the areas indicated in this study will be considered in more detail." Structurally, the following sections are highlighted in the article: Analysis of the threat of new players, Analysis of the threat of substitute products, Analysis of the market power of suppliers, Analysis of the market power of consumers, Analysis of the level of competition, the Driving forces of the Chinese gas industry, the Restraining forces of the Chinese gas industry, as well as Conclusion and Bibliography. The beginning of the article reflects the relevance of the research, its object and subject, the problem being solved, the purpose and objectives of the work, scientific novelty. The authors note that China's gas industry cannot meet the rapidly growing demand for gas from its own resources, and therefore depends on imports of hydrocarbons, cite data on gas production in China and its imports for 2010-2020, differentiating between imports of liquefied natural gas and imports via pipeline; note that China occupies the third position in the the ranking of the largest gas consumers in the world. The article evaluates the competitive forces operating in the PRC gas industry according to the M. Porter model, shows the main gas suppliers to the country, potential newcomers to the industry, main competitors in the industry, existing alternatives: coal, nuclear energy, hydropower, solar energy; reflects the structure of energy consumption in China in 2020, shows the predominance of coal (57%), the share of oil (19%), renewable energy (14%) and gas (19%). A separate table analyzes gas consumption in the provinces and municipalities of China in 2021, reflects the driving and restraining forces of the PRC gas industry based on M. Porter's Model. In conclusion, 4 conclusions are formulated based on the results of the study, and suggestions are made to improve the competitiveness of the industry. The bibliographic list contains a description of 24 sources used by the authors, to which there are address references in the text. The relevance of the topic of the article, its correspondence to the subject of the journal, possible interest from potential readers, presentation of the material in a visual form, indicate the possibility of publishing a peer-reviewed article.

|

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.

Eng

Eng